Shopify: 3 lessons from investing $55 million in 40 carbon removal startups

GreenBiz

JANUARY 2, 2024

Shopify’s head of sustainability, Stacy Kauk, shares secrets from four years of investing in early-stage carbon removal.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

GreenBiz

JANUARY 2, 2024

Shopify’s head of sustainability, Stacy Kauk, shares secrets from four years of investing in early-stage carbon removal.

GreenBiz

JANUARY 2, 2024

Shopify’s head of sustainability, Stacy Kauk, shares secrets from four years of investing in early-stage carbon removal.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Renew Economy

NOVEMBER 20, 2024

Australia's sovereign wealth fund finally given instructions to invest in what it says on the box - the future - at least in regards to energy technologies. The post Labor issues new mandate to Future Fund to invest in the future, and the zero carbon economy appeared first on RenewEconomy.

GreenBiz

MAY 3, 2023

A group of former Google, SolarCity and Tesla executives in April snagged $20 million in what is being called the largest ocean-based carbon removal investment to date.

GreenBiz

JULY 9, 2024

Governments can play a key role in the success and longevity of carbon markets — specifically by backstopping early investments.

GreenBiz

APRIL 21, 2022

Kelp farming is ready to scale but getting more processing plants, increasing demand and understand the carbon impact need to come first.

GreenBiz

JULY 13, 2022

Launched by Stripe this spring, Frontier has announced its first six project winners: AspiraDAC (a subsidiary of Corporate Carbon), Calcite-Origen (a collaboration between 8 Rivers and Origen), Lithos, RepAir, Travertine and Living Carbon.

GreenBiz

MARCH 26, 2024

Toymaker signs 9-year deal with Climeworks of Switzerland.

GreenBiz

DECEMBER 13, 2023

Scientists agree carbon removal technology is necessary to mitigate the climate crisis — but it needs more investment.

GreenBiz

JANUARY 27, 2023

Featuring Stacy Kauk, head of sustainability for Shopify, and an advocate for investments in carbon removal technology.

GreenBiz

AUGUST 19, 2022

Espejo de Tarapaca, Climate Investor Two and Africa's energy guarantee facility are all making climate-smart investing the obvious choice.

Envirotec Magazine

FEBRUARY 24, 2022

Investing in the ground beneath our feet could have wide-ranging benefits for the environment, animal and human health – as well as moving closer to Net Zero, according to new research. Soil acts as a carbon ‘sink’, locking in GHGs that would otherwise be released into the atmosphere.

Inhabitat - Innovation

SEPTEMBER 11, 2020

A European group of global investment managers and pension funds has devised an ambitious plan to cut their portfolios down to net-zero carbon.

Envirotec Magazine

AUGUST 1, 2022

Multi-million-pound investment is urgently needed in technologies including direct air capture (DAC) if the UK is to make ‘green’ airports a reality in the future, research by Cranfield University seems to reveal. DAC works by capturing CO2 in the air and then either sequestrating it or using it to manufacture carbon neutral fuel.

Impact Alpha

AUGUST 21, 2024

London-based Just Climate was launched in 2021 by Al Gore’s Generation Investment Management to invest in growth-stage, asset-heavy companies that are reducing greenhouse. The post Just Climate invests $150 million in Continuum Green Energy to reduce India’s industrial carbon emissions appeared first on ImpactAlpha.

Impact Alpha

JUNE 27, 2024

The post Blackhorn raises $150 million to invest in digital infrastructure for the low-carbon transition appeared first on ImpactAlpha. Denver-headquartered Blackhorn Ventures backs early-stage clean tech companies that are addressing industrial resource efficiency. The firm sees a $1.7 trillion opportunity as new.

BloombergNEF

SEPTEMBER 18, 2024

18 September 2024, London – As this year’s G-20 President and the host of COP30 in 2025, Brazil has a historic opportunity to lead the global transition to a low-carbon economy. Trillion Opportunity in Low-Carbon Energy Supply Investments, According to BloombergNEF appeared first on BloombergNEF.

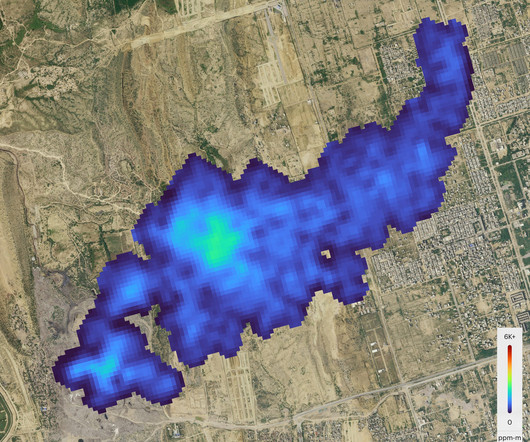

Planet Pulse

OCTOBER 10, 2024

Tanager-1 is made possible by the Carbon Mapper Coalition , a philanthropically-funded effort to develop and deploy satellites designed to detect and track methane and CO2 super-emitters at a level of granularity needed to support direct mitigation action. Carbon Mapper’s preliminary estimate of the emission rate is 1,200 kg CH4 /h.

Charged

NOVEMBER 11, 2024

Diamond Edge Ventures (DEV), the US-based investing arm of Japan’s Mitsubishi Chemical , has invested in Boston Materials , a US startup manufacturing critical materials for semiconductors, aerospace parts and automotive components. DEV co-led the company’s $13.5-million

FuelCellsWorks

OCTOBER 18, 2023

Considerable private investment is required to scale up the low-carbon hydrogen economy in the United States by 2030, a report by consultancy Wood Mackenzie said on Tuesday, adding that the $7 billion.

Impact Alpha

JANUARY 4, 2024

The post Canada Growth Fund invests in Entropy and contracts for carbon storage appeared first on ImpactAlpha. ImpactAlpha, Jan. 4 – In one of the first deals of its kind, the government-backed Canada Growth Fund entered into a long-term offtake.

BloombergNEF

OCTOBER 5, 2023

Staying on track for net-zero emissions requires at least $4 dollars to be spent on low-carbon energy supply for every dollar that goes to fossil fuels throughout this decade. The post Regional Investment in Low-Carbon Energy Is Short of Net-Zero Path appeared first on BloombergNEF.

Hydrogen Fuel News

OCTOBER 16, 2024

Koloma Secures Major Investment from Industry Giants Koloma, a leading geologic hydrogen startup, has successfully raised a $50 million Series B extension round, marking a significant milestone in the renewable energy sector. It is produced by geological processes that cause hydrogen to seep from the Earth’s crust.

Envirotec Magazine

MARCH 27, 2024

The introduction of a carbon credit scheme, enabling companies to invest in the restoration of the UK’s degraded saltmarshes and voluntarily offset their greenhouse gas emissions, would be viable, a study led by the UK Centre for Ecology & Hydrology (UKCEH) has found. million tonnes of carbon.

Energy Central

APRIL 29, 2024

Reducing low-carbon hydrogen investment and operating costs A prerequisite for mass adoption While several levers have already been used to reduce the cost of investing in and using low-carbon hydrogen, many can still be mobilized by players throughout their value chains (equipment developers and producers in particular).

Hydrogen Fuel News

JULY 19, 2024

American multinational conglomerate, 3M, has announced it has invested in Ohmium International, a green hydrogen company specializing in the development of electrolyzer systems for the production of renewable hydrogen. The investment in the green hydrogen company aligns with 3M’s strategic growth platform in climate technology.

Terra Infirma

OCTOBER 30, 2024

Here is my immediate reaction based on the Chancellor’s speech and some skimming of the official budget documentation : Transport: new investment in rail, a modest rise in ‘normal’ air passenger duty and a whopping hike for private jets are all moves in the polluter pays direction.

The Guardian: Energy

SEPTEMBER 25, 2024

Letter says technologies to produce blue hydrogen and capture CO 2 are unproven and could hinder net zero efforts Leading climate scientists are urging the government to pause plans for a billion pound investment in “green technologies” they say are unproven and would make it harder for the UK to reach its net zero targets.

R-Squared Energy

NOVEMBER 12, 2024

Many climate activists are deeply concerned about the impact of Donald Trump’s recent election victory on efforts to reduce carbon emissions. While economists caution that these tariffs could lead to a resurgence in inflation, they may also bring about a lesser-discussed impact that could affect global carbon emissions.

Charged

NOVEMBER 5, 2024

General Motors (GM) has entered into a new investment agreement with Lithium Americas to establish a joint venture (JV) to fund, develop, construct and operate the Thacker Pass lithium carbonate project in Humboldt County, Nevada. billion US Department of Energy (DOE) loan announced earlier this year.

Hydrogen Fuel News

MARCH 3, 2024

Exploring the world of carbon capture technology opens up a pathway to understanding how advanced science is being utilized to combat the pressing issue of climate change. Post-combustion capture The core principle of carbon capture technology is simple yet incredibly sophisticated.

Renew Economy

AUGUST 31, 2022

Is carbon capture and storage a realistic climate solution, or a subsidy harvesting exercise to extend the life of fossil fuel assets? The post Carbon capture remains a risky investment for achieving decarbonisation appeared first on RenewEconomy. We review 13 projects to find out.

Impact Alpha

FEBRUARY 4, 2021

4 – French investment manager AXA invested debt and equity from The AXA IM Impact Fund: Climate and Biodiversity. The post AXA invests $11 million in Forest Carbon to restore wetlands in Indonesia appeared first on Impact Alpha. ImpactAlpha, Feb. Bonds will.

Impact Alpha

FEBRUARY 14, 2023

The post Private equity giants double down on the low-carbon transition and impact investing appeared first on ImpactAlpha. ImpactAlpha, Feb. 14 – Brookfield Asset Management made waves last June when it closed fundraising for its $15 billion energy transition fund, the.

The Guardian: Energy

MARCH 30, 2024

One of its most eye-catching initiatives is a proposal to trap carbon dioxide at a vast oil refinery and petrochemical complex on the south coast and store it under the seabed of the English Channel. Continue reading.

TechXplore

OCTOBER 16, 2024

Amazon on Wednesday said that it was investing in small nuclear reactors, coming just two days after a similar announcement by Google, as both tech giants seek new sources of carbon-free electricity to meet surging demand from data centers and artificial intelligence.

DeSmogBlog

AUGUST 27, 2024

This story is the second part of a DeSmog series on carbon capture and was developed with the support of Journalismfund Europe , and in partnership with Follow the Money. Sections of pipe for the Porthos CO2 pipeline, intended to take captured carbon emissions and inject them under the North Sea, await burial at the Port of Rotterdam.

Hydrogen Fuel News

SEPTEMBER 7, 2024

In fact, some predictions expect investing will into low-CO2 power be nearly twice that in fossil fuel Worldwide spending on clean energy infrastructure and tech is currently aligned to reach $2 trillion by the close of this year, even as new projects face challenges due to higher financing costs.

Impact Alpha

AUGUST 30, 2021

ImpactAlpha, August 30 — “The vast majority of innovation and transformation concerning climate change will happen in private markets,” says Carbon Equity’s Jacqueline. The post Carbon Equity secures €1.2 million to lower minimums for private climate investing appeared first on ImpactAlpha.

Hydrogen Fuel News

JUNE 26, 2024

The new law will provide developers with tax rebates as high as 40 percent on project costs Canada has just passed a major clean hydrogen investment tax credit (formerly known as the C-69 bill), which will provide H2 developers with tax rebates as big as 40 percent off their project costs when they develop within the country.

The Guardian: Energy

OCTOBER 4, 2024

Is this method of preventing carbon emissions from entering the atmosphere a silver-bullet solution for the climate crisis? The government has committed almost £22bn over 25 years to developing CCS in a big investment promise designed to reignite Britain’s struggling industrial heartlands. Continue reading.

DeSmogBlog

OCTOBER 7, 2024

This story is the third part of a DeSmog series on carbon capture and was developed with the support of Journalismfund Europe and published in partnership with the Guardian. Others engaging regularly with ministers on CCS policy include heavy manufacturing companies, CCS technology firms, lobby groups, and investment funds.

Renew Economy

JUNE 16, 2024

Telstra will no longer buy carbon credits and instead invest directly in decarbonisation, a move Andrew Macintosh says others should consider. The post Telstra dumps offsets and “carbon neutral” claims: Whistleblower says others should do the same appeared first on RenewEconomy.

BloombergNEF

DECEMBER 14, 2023

Investment in energy supply, including low-carbon sources, increased last year as the recovery from the Covid-19 pandemic and Russia’s invasion of Ukraine triggered a spike in commodity prices and capital investment in energy assets.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content